Circular Flow Of Income In A Tripartite Economy

Question

Task: How does the circular flow income work in a tripartite economy? Describe the method of calculating National income and state the importance of National Income Statistics.

Answer

How do you explain the circular flow of income?

Circular flow of income is referred to an activity where the national income and the expenditure made in an economy continuously flow in a rotational manner. It is a theory which states how money travels within an economy; in particular, it shows the movement of money from businesses to individuals and vice-versa, completing the circular flow of income.

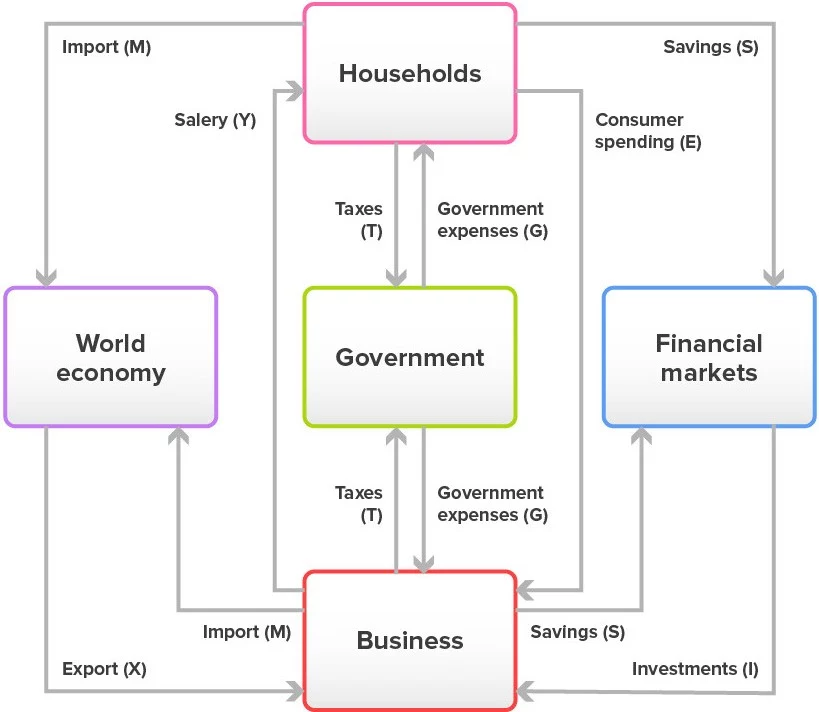

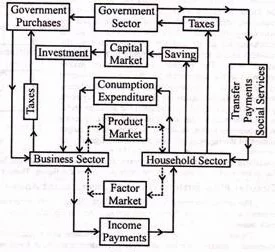

In order to complete the Circular flow of income, the contribution of household, business and government sector are the most important factors. An economy consists of inflows or injections and leakage (Mao, Li, Pei and Xu, 2018). Leakage refers to the savings made and inflow refers to the investments made. The national income comprises of income and product from the household sector, income from the business sector and product from the government sector.

What are the three sectors of the economy?

The three sectors of an economy are:

- Household: Household sector helps to provide the basic factors used in the production like land, labor, capital and enterprise. These factors are required by the business producers to manufacture goods and services. The business sector provides payment to the householders for their services in the type of rent, payment of wages, profits and interest. Household sector is home to a large number of consumers as compared to other sectors. If a business house is able to satisfy their wants and needs then it will be in a position to achieve its aim.

- Business: Business sector receives its resources from the household sector and in turn it provides finished goods and services. The sector also receives money to buy such resources which are scarce in nature. The sector receives money by selling the products and services manufactured by them.

- Government: The government sector by providing its services helps to complete the circle. Taxes placed by the government create a leakage in the circular model and the purchases made by them inject the circular model (Murray, Skene and Haynes, 2017). To understand the phenomena, let’s take an e.g. the household sector pays the government by submitting different taxes like income tax, service tax, etc. which forms a part of the outflow or the leakage. The government also purchases certain services from the households and makes payment in the form of pensions, sickness benefits, education, constructing parks, etc. which helps in injecting the circular flow of income.

The circular flow of income between the household and the government sector

The payment of direct and indirect taxes by the household sector helps to build up a leakage in the circular model likewise the purchasing of goods along with providing services to the households helps the government to inject the circular flow of income.

The circular flow of income between the business and the government sector

The payment of direct and indirect taxes by the business sector helps to build up a leakage in the circular model likewise government sector purchases the products and services produced by the businesses to inject the circular flow of income.

The circular flow of income between the household, business and the government sector

Application of taxes helps in creating a leakage in the circular flow of income in turn reducing the saving and consumption capacity of the household sector. When the consumption reduces, it affects the disposal of the goods and services of a particular business sector (Reisman, 2018). Taxes also reduce the investment and productions made by the firms and thereby reduce their profits. The government in turn reduces the leakage made in the circular flow of income by making a purchase of goods and services from the business as well as the household sector. The process helps in equaling the taxes, sales and production. The equilibrium will be reflected in the circular flow of income and expenses of the economy.

Source: (Chand, n.d)

The above image depicts the movement of taxes from the household and the businesses to the government and in turn government makes investments and purchases from the businesses as well as the household. If the purchase made by the government exceeds the taxes received then it will be in a deficit (Tsoulfidis and Tsaliki, 2019). In such situation the government has to manage the deficit by taking a loan from the capital market which in turn receives its funds from the savings made by the households.

If the net tax collected by the government exceeds the purchases made by it then the government will have a surplus budget. In such a situation the government has to reduce the debt taken from the public and supply the extra fund into the capital market so that it can be received by the firms.

Significance of Circular flow of income model

The circular flow of income helps to understand about the working of the economy. Whether the economy is working smoothly or it is facing any disturbance can be judged by applying the circular flow of income. It acts as a significant element for those who are looking to study the economy of any country and it also helps the government of the specific country to formulate policies (Beal and Astakhova, 2017). Some of the significant points of the circular flow have been mentioned below:

- Studying about disequilibrium problems: The circular income flow helps to understand the problems causing the disequilibrium and to find the solutions which can restore the equilibrium.

- Effects of injections and leakages: Injections and leakages play an important role in an economy of a country. Importing from a foreign country is a leakage made within the circular flow of income due to the payments made to an outside or foreign country. In such a situation the government has to take appropriate steps to stop the leakage which can be done by increasing the exports and decreasing the imports.

- Circular flow of income is interrelated with producers and consumers: The producers are in need of the factors of production from the households so they use their income to purchase their services and the consumers in turn purchase the goods and services that have been manufactured by the producers.

- Arranging the market: Basis the connection maintained between the producers and the consumers, the circular flow helps in creating a network of different markets. The network helps in solving the problem related to sale and purchase of different goods and services.

- Controlling the inflation and deflation: Inflow and leakages in the circular flow of income interfere in the functioning of an economy. Saving can be considered as a form of leakage made in the expenditures and if it increases, it leads to reduced circular flow of income. It also reduces the employment, the income and the prices which lead to a deflation in the economy whereas consumptions increases employment, income, output and prices leading to inflation in the economy.

- Acts as a multiplier: When the leakage exceeds inflow, it leads to reduction in total income compared to total output. It leads to a reduction in the employment, the prices, output and income. When the inflow exceeds the leakage then the income increases in the economy leading a rise in the employment, prices, output and income earned by an economy. It can be said that the Keynesian Multiplier shows the movement of the circular flow of income (Charles, 2016).

- Significance of monetary policies: The movements in the circular flow of income helps in the formulation of different economic policies in order to equate the savings and investments made in the economy. Credit or capital market helps to maintain equality in savings and investments. The government tries to control the credit market through its monetary policies. When there is an increase in the savings than the investment or the vice versa, policies related to money or credit helps in controlling the spending. The process helps to control the fluctuating prices in an economy.

- Significance of fiscal policies: Circular flow of income and expenses helps to evaluate the significance of the fiscal policies (Shubik and Sudderth, 2016). In contrary, when I+G exceeds S+T, the government will change its revenue and expenditures by promoting income from the investments and taxes (Economic discussion.net, n.d). The revolving flow of revenue and spending thus shows us the value of compensatory fiscal policy.

- Significance of trade policies: Imports are a form of leakage created in the circular flow as they reflect the payments which has been made in a foreign country. In order to control the outflow the government takes some measures to encourage exports and discourage imports. The process helps to promote policies related to import and export.

- Foundation of funds account: The national income can be calculated basis the flow of funds in the account generated by the circular flow. The flow in the funds account is maintained by different monetary transactions made in the economy.

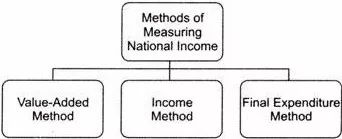

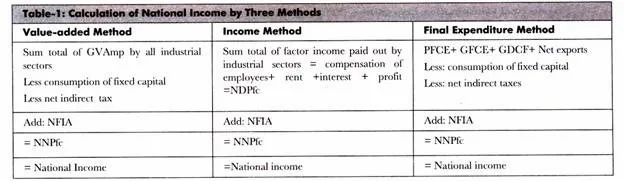

Calculation of National income

To keep a record of financial transactions, a business is involved into various accounting processes which determine its financial status. In the similar manner, a country has to check its financial status through its GDP which is Gross Domestic Product helping in the calculation of the national income (Solt, 2016). The calculation helps to assess the growth of the economy. National income signifies the total worth of the goods and services which is produced in a country within a specific time period which is a year. The three ways to calculate the national income has been shown and described below the image:

Source: (Economic discussion.net, n.d)

1) Value added method: It is also sometimes called as net output method. The value added method helps to analyze the contributions made by different economic

production units in the GDPmp. In a layman’s language, value added method calculates the value which has been added by all the industries in the economy (Economic discussion.net, n.d). In order to calculate the national income with the help of value added method, the first step is to calculate the

Grass Value Added at market price, (GVAmp), the next step is to calculate the (NVAmp) and the last step is to calculate the (NVAfc). In order to reach by a business, the following is to be subtracted from the value of output by a business:

- Intermediary consumption which includes the prices of goods like raw materials and fuel bought from different firms.

- Consuming the fixed capital that is depreciation

- Taxes which are indirect

To conclude, the by each business of an industry provides the net value added at factor cost of every industry. When the net value added at factor cost by each industry is added, it helps to get the (NDPfc) (Feldstein, 2017). Finally, is added with the coming from outside to achieve , called as national income. Therefore,

NI or NNPFC = NDPFC + Net factor income from abroad

The method discussed above will come into use when the total production in a year is available. Some of the countries keep the production data of all the important industries. In order to employ the above method, help from other methods should be sought in order to get the national income (Solt, 2016). The method helps in the revelation of the contributions and importance of each industry in an economy as well as in the national income.

Some precautions to maintain while calculating the national income with the help of value added method has been enumerated below:

- The imputed value of rent in self-used houses must be added in the value of output. Although no person is paid in this situation but its value can be estimated basis the prevailing worth in the market.

- Amount generated through sell or purchase of used goods must be excluded while measuring the value of an output because its value was already counted when it was produced (Chand, n.d). The earning of commission or brokerage by the sale of such good must be included as it is a fresh service generated in the present year.

- Productions made for personal use must also be included while assessing the national income and its value can be estimated basis the prevailing worth in the market.

- The services provided by a housewife are not included as the worth of their services cannot be assessed.

- Worth of the intermediate goods should not be included as this will lead to double counting.

2) Income method: At times called as factor income method. The method is helpful in calculating the income available with the factors of production (capital, labor, land and organization) which is used to produce national product. Rent, interest, compensation paid to the employees and profit are the factors of payment. Another category of payment factor is the mixed income (Solt, 2016). The factors of payments are being discussed below:

- Rent: It is the payment made by a tenant to his or her landlord. When the national income is measured, rent received from land is only included. When a landlord leases his land for miming purposes, the royalty he receives is included in the national income.

- Compensation paid to the employees: When the employees render their services in the manufacturing of goods and services, they are paid a remuneration which serves as a compensation for their work. The compensation can be in the form of wages, salaries and contributions made for their social security.

- Interest: The amount which is paid by the factor in lieu of the borrowed money is interest. Money is borrowed by production units for the investments being made and it is borrowed by the household in order to meet their daily expenses (Chand, n.d). But while calculating the national income, the interest paid by the production units is only considered.

- Profits: It relates to the amount earned above the investments made by the production unit. Profits are to be divided in three parts, payment of income tax, dividend paid to the shareholders and lastly the profit which has been retained back.

- Mixed income: The earnings made by farming enterprises, medical and legal professionals or sole proprietorship, comes under this category. In such professions the owner performs all the roles including, entrepreneurship, financing, working and owning. Therefore,

Net income rent + Wages + Interest + Profit + Mixed Income

The steps involved in the calculation are as follows:

- Classifying the production units into priman’, secondary, and tertiary sectors.

- Estimating Net Value Added (NVAfc) of each sector. The sum total of the factor payments equals NVAfc.

- Taking the sum of NVAfc of all the industrial sectors of the economy. This will give NDPfc.

? NVAfc = NDPfc

- . Estimating NFIA and adding it to NDPfc, which gives NNPfc (national income).

NDPfc + NFIA = National Income (NNPfc)

Some precautions to maintain while calculating the national income with the help of value added method has been enumerated below:

- Payments in the form of transfers made are not included while calculating the national income.

- The imputed value of rent in self-used houses must be added in the worth of output due to its occupancy by others. Its value can be estimated basis the prevailing worth in the market.

- Money which has been generated through illegal sources like hawala, smuggling, etc. should not be included.

- Money made through lottery or winning a prize should not be included.

- Corporate profit tax which is a tax on the income of a company should not be included.

- Duties paid on death, taxes paid on gifts, etc. should not be included as it is paid from previous savings.

- Payments received from selling of used goods shall not be included.

- The income which equals the worth of production which is used for personal consumption will be inclusive in the national income.

3) Expenditure Method: It is also sometimes called as final product method. The method helps in measuring the expenditures made by the production units while producing the final product or services. The production is made within the economy during a specific time which is one year (Mao, Li, Pei and Xu, 2018). The expenditures can be incurred both on consumption and investment. The method helps in calculating the national income from the purchasing point of view. Income involves money spent on customer goods and capital goods. Expenses involve money made by individuals and private households or expenditure made by government and different business enterprises. Foreign nationals also spent on certain products and services which are exported to them. Likewise residents of a particular country also spent on goods and services imported by them. Adding up the below expenditures helps to generate the national income:

- Expenditure made on consumable goods and services by consumers and households. It is called as final private consumption expenditure, which is indicated by C.

- Expenditure made by the government on the goods and services satisfying the group wants. It is called as goverment final consumption expenditure which is indicated by G.

- Expenditure made by productive enterprises on the capital good and inventory or stock. It is also called as gross domestic-capital information or gross domestic investment which is indicated by I or GDCF.

- Gross fixed capital

- Addition made to the stock or the inventory of goods

- Expenditure incurred by foreign nationals on goods and services exported from home country to other country which is called as exports, indicated by X. We deduct from expoits (X) the expenditure by people, enterprises and government of a country on imports (M) of goods and services from other countries. That is, we have to estimate net exports (that is, exports -imports) or (X—M) which is also denoted by NX.

- The expenses incurred on used goods or second hand goods shall be excluded due to its zero contribution in the current year.

- The expenses incurred on purchasing of previous shares and bonds from people or business enterprises shall not be included while calculating the GDP through this method. It is so as bonds and shares are bare claims.

- The expenses made on transfers processed by the government in the form of unemployment benefits, pensions, etc. shall not be included due no production of goods or services.

- The expenses made on intermediate goods like fertilizers and seeds used by the farmers, wool, yarn and cotton used by the manufacturing industries for making cloth, shall not be included.

- The expenses incurred on the production of goods for personal consumption shall be included.

The formation of Gross domestic capital is split in two parts:

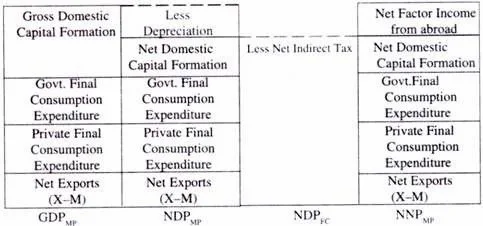

Therefore, the four expenditures mentioned above are added to get the final expenditure on GDP at market prices (GDPmp). Thus,

GDPsp = Private final consumption expenditure + Government’s final consumption

expenditure + Gross domestic capital formation + Exports — Imports or

GDPMP = C + G + I +(X — M)

C + G + I + NX

On deducting consumption of fixed capital (i.e., depreciation) from gross domestic product at market prices (GDPMP) we get net domestic product at market prices (NDPMP).

En this method, we then subtract net indirect taxes (that is, indirect taxes — subsidies) to arrive at net domestic product at factor cost (NDPFC),

Lastly, we add ‘net factor income from abroad’ to obtain net national product at factor cost

(NNPFC), *hich is called national income. Thus,

NNPFC = GDPMP — Consumption of Fixed capital — Net Indirect taxes + Net Factor Income

from Abroad.

Source: (Economic discussion.net, n.d)

The expenditure method to calculate the national income is shown in the above diagram.

Some precautions to maintain while calculating the national income with the assistance of expenditure method has been enumerated below:

Source: (Economic discussion.net, n.d)

Question/Answer session:

Question1) Predict one of exceptions considered by income method in order to calculate national income:

- Salary

- Profit arising from sale of used goods or second hand goods

- Rent

- Mixed income

Answer) The correct answer is (b), the method does not consider sale of used goods.

Question2) Predict one of exceptions considered by Expenditure method in order to calculate national income:

- Salary

- Transfer payments made by government

- Rent

- Mixed income

Answer) The correct answer is (b), the method does not consider payments transferred by the government as there is no production of goods or services.

Question3) Predict one of exceptions considered by value added method in order to calculate national income:

- Salary

- Value added by intermediate goods

- Rent

- Mixed income

Answer) The correct answer is (b), the method does not consider the valuation of intermediate goods in order to avoid double counting.

National Income Statistics and its uses

Many learners define national income as the total earnings of a particular country. National income statistic is used to measure the country’s total funds and properties which are essentially a set of rules, techniques and formulas for calculating the total value of the final goods and services (Kristal, 2018). The national income statistics are, however, only true for measuring a country’s national income in a particular year.

Its uses

The national income statistics plays a principal role in evaluating the growth of an economy. It enables the economists to note down about the current structure of an economy. It helps to showcase the efforts put in by different sectors in a particular year. Income available with a country helps to evaluate the living standard of an individual as well as the country. It is said that a country having a higher national income has a higher living standard for e.g. it is considered that United Kingdom has a higher living standard as compared to Ireland due to its higher national income.

The national income statistics can also be used to compare over time. It helps a country who is into the act of keeping all the old records in order to determine its progression, stagnation or deterioration. In case it is seen that the country is in a stagnant or deteriorating phase then the government along with its citizens will put in efforts to improve the position of the country by taking actions to improve the national income of an economy (Kristal, 2018). It can be seen that the economy of Iran is in a deteriorating phase and the government of the country is looking into ways to improve the condition.

As said previously, national income of a particular country helps to check the health and status of its economy and to take better decisions for its development. It helps in making comparisons among different countries (Barra and Zotti, 2018). The countries having lesser national income can adopt the policies being framed and practiced by countries having a higher national income. It has been seen that China in 20th century adopted the economic policies being followed by Japan to improve its national income. The changed strategies of China helped it in boosting its economy as well as placing it as one of the topmost powerhouse in the world. The study also helps to fix and payback the loan taken from international agencies.

Every country fears from inflation. When the expenses exceed output without a change in the prices, it leads to high inflation. It is an unpredictable phenomenon which can lead to depreciation of the currency or a financial calamity. But now countries are using the national income statistics to predict its future in order to avoid any crisis. Economists can compare the health and functioning of an economy basis the previous year data generated through national income statistics. They can predict about the future economic condition of their country. The predictions may not be real but it will help the government to prepare itself with some economic policies which can control the future inflation or deflation. Policies related to taxation are formulated as per the national income. Policies related to borrowing are also formulated as per the national income.

The national income statistics also helps by making a contribution in the different sectors of an economy. Through the data, the sector which has majorly contributed in the growth of the economy can be identified and the government can focus on the sector which has contributed less.

National income statistics consists of data related to consumption, investment, import, saving and exports which helps in identifying the performance of public and private sector in the economy (Barra and Zotti, 2018). It helps to note which sector is in a developing state and it also helps to understand the type of expenditure being made in the country. If majority of the activities is performed by a state, it can be said that public sector is in a dominant position.

National income statistics also helps in evaluating the planning process of a country along with the evaluation of different sectors of the economy. The government can formulate different long term and short term policies basis the comparison of different statistics generated in the previous years (Barra and Zotti, 2018). Every country uses its national income statistic data to formulate its future plans.

Circular flow of income showcases different financial transactions made in the economy by different sectors. It helps to establish a connection among saving and investment and among lending and borrowing. One of the major difficulties coming in the way of calculation of national income of developing countries is lack of statistical data. National income statistic plays an important role for determination of the economy of a country. It helps in formulating plans in order to control financial crisis. The study of different concepts like circular flow of income, methods of calculating the national income and uses of national income statistic will help in understanding and contribution to one’s economy.

Reference List

Economic discussion.net, (n.d) Methods for Calculation of National Income and Circular flow of income. Retrieved from: http://www.economicsdiscussion.net/ Circular flow of income national-income/methods-for-calculation-of-national-income/3961

Chand, S. (n.d) The Circular Flow of Income: Meaning, Sectors and Importance. Retrieved from: http://www.yourarticlelibrary.com/macro-economics/national-income-macro-economics/the-circular flow of income-meaning-sectors-and-importance/30771

Mao, J., Li, C., Pei, Y and Xu, L. (2018) Value flow of a circular flow of income economy. Circular Economy and Sustainable Development Enterprises. Springer: Singapore.

Reisman D. (2018) Circular Flow of income and Social Class. In: Thomas Robert Malthus. Great Thinkers in Economics. Palgrave Macmillan, Cham

Tsoulfidis L and Tsaliki P. (2019) Circular Flow of income and Social Reproduction. In: Classical Political Economics and Modern Capitalism. Springer, Cham

Murray, A., Skene, K. and Haynes, K. (2017) The Circular flow of income in the Economy: An Interdisciplinary Exploration of the Concept and Application in a Global Context. J Bus Ethics 140, 369–380, https://doi.org/10.1007/s10551-015-2693-2

Beal, B.D and Astakhova, M. (2017) Management and circular flow of Income Inequality: A Review and Conceptual Framework. J Bus Ethics 142, 1–23. https://doi.org/10.1007/s10551-015-2762-6

Charles, S. (2016) An additional explanation for the variable Keynesian multiplier: The role of the propensity to import. Journal of post Keynesian Economics on Circular Flow of Income, 39(2).

Shubik M and Sudderth W.D. (2016) Breaking the Circular Flow of income: A Dynamic Programming Approach to Schumpeter. In: Pinto A., Accinelli Gamba E., Yannacopoulos A., Hervés-Beloso C. (eds) Trends in Mathematical Economics. Springer, Cham

Solt, F. (2016) The Standardized World Income Inequality Database. Social Science Quarterly on Circular Flow of Income, 97(5), pp. 1267-1281

Feldstein, M. (2017) Underestimating the Real Growth of GDP, Personal Income, and Productivity. Journal of Economic Perspectives on Circular Flow of Income, 31(2), pp. 145-164.

Kristal T. (2018) The Neoliberal Revolution, circular flow of income and National Income. In: Paz-Fuchs A., Mandelkern R., Galnoor I. (eds) The Privatization of Israel. Palgrave Macmillan, New York.

Barra, C and Zotti, R. (2018) Investigating the non-linearity between national income and circular flow of income: international evidence of Kuznets curve. Environ Econ Policy Stud 20, 179–210. https://doi.org/10.1007/s10018-017-0189-2